Advice for Living Through These Uncertain Times

Stephanie Barritt • May 27, 2020

It only takes a quick trip to the grocery store to realize that life is VERY different than it was just a couple of months ago. COVID-19 has already left a permanent mark in modern human history. So as you continue life mid-pandemic, here's some good advice: don’t believe everything you read on the internet or see in the news.

As it relates to your personal financial situation.

As it relates to the Canadian economy.

As it relates to the value of your home.

As it relates to Canadian real estate values.

Because as the media continues to cover COVID-19, you can expect to see financial doomsday headlines; designed to grab your attention, get more outlandish as time goes on. The goal is to catch your eye with a wild headline so that you read an article (or watch a video) and are exposed to the advertisements contained within.

Media and news companies are in the business of selling advertisements, not providing you with accurate unbiased information.

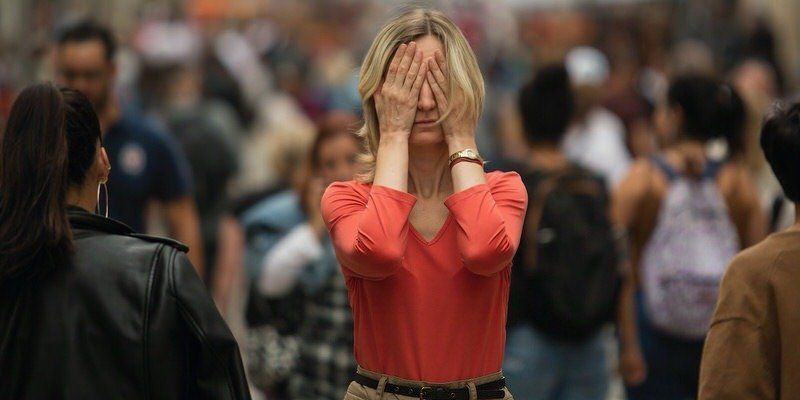

The best way to grab your attention is with an attempt to instil fear or shock. One headline will read that house prices are expected to plummet, the next will claim mortgage defaults are on the rise by a billion per cent, while the next will provide incredible proof that house sales are expected to grind to a screeching halt and will never return to normal.

And although most of these stories contain *some* level of truth, rest assured that what may be true for the rest of Canada (or the US) is not necessarily true about your personal financial situation, your local economy, your local real estate, or your mortgage.

Don’t buy into the hype and get anxious about things you can’t control.

It might be best to just turn off the TV, put down the newspaper, and stop scrolling Facebook. Especially if you aren't thinking of making a move anytime soon anyway! But if your mortgage is up for renewal, if you're thinking of buying a new property, or if you're looking to make a change with your investments, then it's best to talk with local professional and seek their advice!

Be influenced by those who have your best interest in mind!

If you have any questions about your mortgage, please don’t hesitate to contact me anytime. I’d be more than happy to let you know exactly where you stand.

RECENT POSTS

Your Guide to Real Estate Investment in Canada Real estate has long been one of the most popular ways Canadians build wealth. Whether you’re purchasing your first rental property or expanding an existing portfolio, understanding how real estate investment works in Canada—and how it’s financed—is key to making smart decisions. This guide walks through the fundamentals you need to know before getting started. Why Canadians Invest in Real Estate Real estate offers several potential benefits as an investment: Long-term appreciation of property value Rental income that can support cash flow Leverage , allowing you to invest using borrowed funds Tangible asset with intrinsic value Portfolio diversification beyond stocks and bonds When structured properly, real estate can support both income and long-term net worth growth. Types of Real Estate Investments Investors typically focus on one or more of the following: Long-term residential rentals Short-term or vacation rentals (subject to local regulations) Multi-unit residential properties Pre-construction or assignment purchases Value-add properties that require renovations Each type comes with different financing rules, risks, and return profiles. Down Payment Requirements for Investment Properties In Canada, investment properties generally require higher down payments than owner-occupied homes. Typical minimums include: 20% down payment for most rental properties Higher down payments may be required depending on: Number of units Property type Borrower profile Lender guidelines Down payment source, income stability, and credit history all play a role in approval. How Rental Income Is Used to Qualify Lenders don’t always count 100% of rental income. Depending on the lender and mortgage product, they may: Use a rental income offset , or Include a percentage of rental income toward qualification Understanding how income is treated can significantly impact borrowing power. Financing Options for Investors Investment financing can include: Conventional mortgages Insured or insurable options (in limited scenarios) Alternative or broker-only lenders Refinancing equity from existing properties Purchase plus improvements for value-add projects Access to multiple lenders is often crucial for investors as portfolios grow. Key Costs Investors Should Plan For Beyond the purchase price, investors should budget for: Property taxes Insurance Maintenance and repairs Vacancy periods Property management fees (if applicable) Legal and closing costs A realistic cash-flow analysis is essential before buying. Risk Considerations Like any investment, real estate carries risk. Key factors to consider include: Interest rate changes Market fluctuations Tenant turnover Regulatory changes Liquidity (real estate is not easily sold quickly) A strong financing structure can help manage many of these risks. The Role of a Mortgage Professional Investment mortgages are rarely “one-size-fits-all.” Lender policies vary widely, especially as you acquire more properties. Working with an independent mortgage professional allows you to: Compare multiple lender strategies Structure financing for long-term growth Preserve flexibility as your portfolio evolves Avoid costly mistakes early on Final Thoughts Real estate investment in Canada can be a powerful wealth-building tool when approached with a clear strategy and proper financing. Whether you’re exploring your first rental property or planning your next acquisition, understanding the numbers—and the lending landscape—matters. If you’d like to discuss investment property financing, run the numbers, or explore your options, feel free to connect. A well-planned mortgage strategy can make all the difference in long-term success.

So, you’re thinking about buying a home. You’ve got Pinterest boards full of kitchen inspo, you’re casually scrolling listings at midnight, and your friends are talking about interest rates like they’re the weather. But before you dive headfirst into house hunting— wait . Let’s talk about what “ready” really means when it comes to one of the biggest purchases of your life. Because being ready to own a home is about way more than just having a down payment (although that’s part of it). Here are the real signs you're ready—or not quite yet—to take the plunge into homeownership: 1. You're Financially Stable (and Not Just on Payday) Homeownership isn’t a one-time cost. Sure, there’s the down payment, but don’t forget about: Closing costs Property taxes Maintenance & repairs Insurance Monthly mortgage payments If your budget is stretched thin every month or you don’t have an emergency fund, pressing pause might be smart. Owning a home can be more expensive than renting in the short term—and those unexpected costs will show up. 2. You’ve Got a Steady Income and Job Security Lenders like to see consistency. That doesn’t mean you need to be at the same job forever—but a reliable, documented income (ideally for at least 2 years) goes a long way in qualifying for a mortgage. Thinking of switching jobs or going self-employed? That might affect your eligibility, so timing is everything. 3. You Know Your Credit Score—and You’ve Worked On It Your credit score tells lenders how risky (or trustworthy) you are. A higher score opens more doors (literally), while a lower score may mean higher rates—or a declined application. Pro tip: Pull your credit report before applying. Fix errors, pay down balances, and avoid taking on new debt if you’re planning to buy soon. 4. You’re Ready to Stay Put (At Least for a Bit) Buying a home isn’t just a financial decision—it’s a lifestyle one. If you’re still figuring out your long-term plans, buying might not make sense just yet. Generally, staying in your home for at least 3–5 years helps balance the upfront costs and gives your investment time to grow. If you’re more of a “see where life takes me” person right now, that’s totally fine—renting can offer the flexibility you need. 5. You’re Not Just Buying Because Everyone Else Is This one’s big. You’re not behind. You’re not failing. And buying a home just because it seems like the “adult” thing to do is a fast way to end up with buyer’s remorse. Are you buying because it fits your goals? Because you’re ready to settle, invest in your future, and take care of a space that’s all yours? If the answer is yes—you’re in the right headspace. So… Are You Ready? If you’re nodding along to most of these, amazing! You might be more ready than you think. If you’re realizing there are a few things to get in order, that’s okay too. It’s way better to prepare well than to rush into something you're not ready for. Wherever you’re at, I’d love to help you take the next step—whether that’s getting pre-approved, making a plan, or just asking questions without pressure. Let’s make sure your homebuying journey starts strong. Connect anytime—I’m here when you’re ready.